Step-by-Step Guide to Iron Condor: Profit from Sideways Markets

Nov 20, 2024 By Sid Leonard

What if you could earn profits while the market moves sideways? The Iron Condor options strategy offers a way to generate income in low-volatility conditions with limited risk. This guide will take you through the essential steps of executing the Iron Condor strategy, highlighting key factors to consider for maximizing your profits.

Whether you're a seasoned trader or just starting out, understanding how to effectively implement this strategy can help you navigate the complexities of options trading and improve your financial outcomes.

Understanding the Iron Condor Strategy

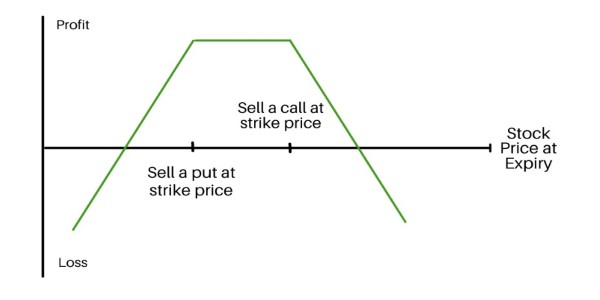

The Iron Condor strategy involves selling a call spread and a put spread on the same underlying asset. All of these options have the same expiration date. This strategy has a defined profit range with limited risk. Since it is based on the expectation that the underlying asset will remain within a certain price range at expiration, it is especially attractive in low-volatility markets.

Traders earn premiums from sold options, and profits are maximized at closing prices within the range determined by the sold strikes. However, both spreads are lost at expiration.

Steps to Follow the Iron Condor Strategy

The Iron Condor is an extremely popular options trading strategy, with the primary goal of taking advantage of low volatility in an underlying asset. It uses four different options - two calls and two puts, all of which have the same expiration date but at different strike prices. Here are the basic steps for opening and managing an Iron Condor:

Step 1: Selection of Underlying Asset

Determine the appropriate basis for the underlying asset as of the Iron Condor. There are known stocks and ETFs that have lower volatility. The starting point would include historical prices and volatility. Those being sideways are better and more likely to follow these kinds of trends as most do not exhibit sudden, dramatic price changes.

Step 2: Analyzing Market Condition

You just need to know the prevailing market conditions to know if you will make it or fail with your Iron Condor. Therefore, a trader needs to know the broad market feeling and the index VIX. The best indicator for an Iron Condor strategy is a low level in the VIX index, which means lower volatility and, subsequently, better chances for the Condor strategy. You are likely to use technical charting tools to find a support and resistance level upon which to base your entry.

Step 3: Determine the Strike Prices

Once you have picked up your underlying asset and analyzed market conditions, the next move is to identify appropriate strike prices for your options. For an Iron Condor, you will need two strike prices for the call spread: one sold, one bought, and two for the put spread. A sold call should be higher than the current price of the underlying asset, and a sold put should be lower. This is the difference in strike prices, which works as a profit range.

Step 4: Establish Expiration Dates

The Iron Condor strategy requires the determination of expiration dates. Normally, traders like options that expire in 30 to 45 days. The period is long enough for you to capture the premium from time decay but also ensures a balance between risk and reward. Remember, shorter dates may mean quicker profits but also higher risks.

Step 5: Execute the Trade

After deciding your strike prices and expiration dates, it's time to get on the trade. Both the call spread and the put spread are sold simultaneously. Most platforms accommodate this as one trade so that you're entering both spreads at once, which makes sense because it eliminates the risk that one leg of the trade will be moved adversely before the other leg is.

Step 6: Monitor the Trade

Once you have established your Iron Condor, you must monitor the movement of the underlying asset and the general market conditions. When the underlying asset moves towards any of your chosen strike prices, you should either roll over your positions or close the position at this time to avoid further losses associated with the trade.

Step 7: Closing the Position

As the expiration date draws near, you will need to decide when to close your Iron Condor. If the underlying asset stays within the range defined by your strikes, both spreads will expire worthless, and you will get to keep the premium collected. However, if the asset moves significantly toward either of your strikes, you will likely want to close the position early to limit your losses. In either case, discipline and a clear exit strategy are crucial.

Benefits and Drawbacks of the Iron Condor Strategy

Here are some key benefits and drawbacks of using the Iron Condor strategy:

Benefits of the Iron Condor Strategy

Flexibility and Versatility: The strategy can easily be used under several types of market conditions. Although it is successful under low-volatility conditions, it can easily adapt the strike prices and the expiration date to the market's trading.

Psychological Gains: Established risk and the possibility of easy income will reduce emotional exposure in trading. Better results will ensure more discipline in decision-making.

Drawbacks of the Iron Condor Strategy

Limited Scope of Profits: The profit is capped at the premium received, as both spreads expire worthless. This is less attractive in strong trending markets.

Sensitivity to Market Movements: The strategy hinges on the underlying asset remaining within a particular price range. Large price movements, especially due to volatility, will cause loss.

Conclusion

Iron Condor is another balanced options trading approach. It describes a limited kind of risk nature with the possibility of steady income. It could work for those adept at stable markets, as that is its biggest downfall. It has capped profits to draw from and can let huge changes in price take full effect. Knowing both aspects will guide traders better in choosing whether the Iron Condor suits their goals or is within their risk-taking appetite.